|

||

|

||

|

|

||

The Odds for a NASDAQ 100 rebound

Posted by Derek Tomczyk on Apr 16, 2014 - 12:00am

I recently took a look at the Biotech ETF IBB and concluded that while the odds are the investment is ready to rebound they're not great in the very short term. In addition it appears that while the investment positive return odds are good on a 2 month time-frame they carry above average risk of a large draw down in case of negative outcomes. I will now compare this result with a similar analysis for the Powershares NASDAQ 100 ETF (QQQ)

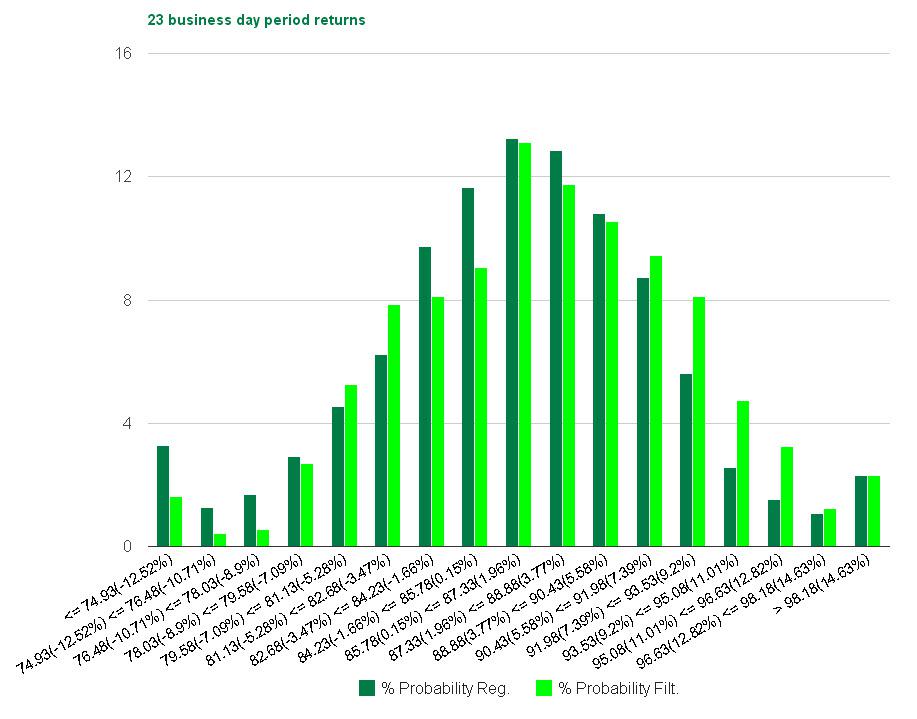

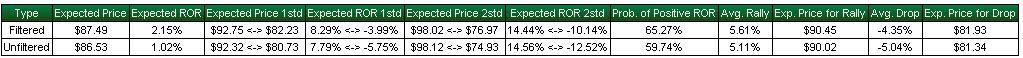

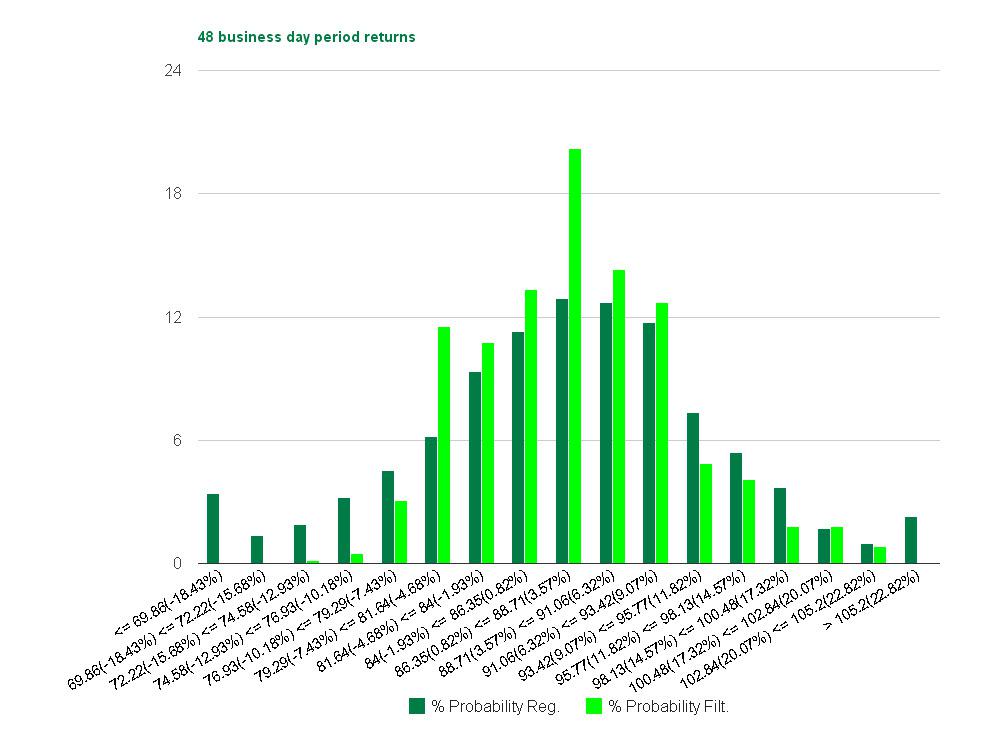

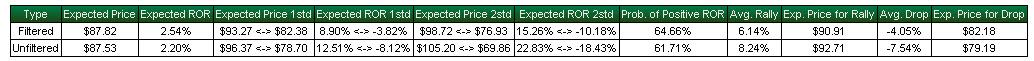

The histograms below have the probabilities in percentage on the left y-axis and ranges of prices/returns on the bottom x-axis. The dark green indicates historical probabilities without consideration for the current point in time while light green probabilities are calculated based on periods with similar characteristics to today.

First probabilities for May 17th

In contrast to the May 17th probability histogram for IBB the QQQ histogram appears to show a slight tilt to positive outcomes especially ones larger than normal. Notice the light green bars are far higher than the dark green bars for QQQ returns between 7% and 13%. In addition this distribution appears to have less than normal probabilities of negative returns.

The stats confirm the favourable expectations with an expected return more than twice the norm for May 17th. The average rally is slightly higher than normal while the average drop is lower than normal and the probability of a positive return is 65% versus 60%. The 1st standard deviation of returns is where the majority of the improved odds are which means the bet would be one that is expected to pay off a large percentage of the time. This looks like a very good risk/reward opportunity for any position exposed to long QQQ, even holding the ETF outright.

Next probabilities for June 21st

The probability curve for June 21st is far more narrow then normal. This does not tell us so much about the direction but rather indicates an expectation of a more narrow range of outcomes. The curve is titled to the positive side a bit, but mostly due to a reduced probability of very negative outcomes rather than an expectation of very positive outcomes.

The stats also tell us a similar story with the expected ROR for the period being larger than normal but not quite as extreme as for May 17th. The probability of a positive investment return is above normal, but less so, and the average rally is less than normal but so is the average drop.

This is a situation where an outright position in the ETF or a deep in the money option are better choices than out of the money option bets. The probability of a large loss on QQQ by June 21st, in direct contrast to IBB, is far below normal so exposing yourself to the risk is a better choice than paying a premium for protection. There is a also a larger than normal probability of a return up to 9% so a leveraged position may a good choice at this time. Therefore much better opportunities for call option positions out of the money lie in the May 17th option chain.

Click here to search for QQQ options that will generate a profit by May 17th given an average rally

While I try to stick to the facts throughout the rest of the web site the blog is the "unplugged" piece and is entirely my personal opinion which is very likely wrong and should definitely not be used for making investment decisions.

The S&P 500 Still Not Overvalued Taking Into Account Interest Rate Environment

What we see is that outside of the depths of the 2008 financial crisis, the S&P 500 is still the cheapest it has been since around 1988. What is also evident is that the bull market that followed 1988 drove stock valuations to extremely overvalued levels but did not actually end until 2001.

read more ...

Earnings Yield On S&P 500 Points To Higher Levels By End Of 2014

In a lower interest rate environment the required return on capital on equity investments should be lower than would otherwise be the case. The longer this environment is expected to persist the lower the required rate of return on perpetuities such as equities would logically be.

read more ...

The Odds for a NASDAQ 100 rebound

The probability of a large loss on QQQ by June 21st, in direct contrast to IBB, is far below normal so exposing yourself to the risk is a better choice than paying a premium for protection. There is a also a larger than normal probability of a return up to 9% so a leveraged position may a good choice at this time. Therefore much better opportunities for a call option positions out of the money lie in the May 17th option chain.

read more ...

The Sell Off in Biotech is Coming to an End

The stats also tell us that the odds are tilted in the favor of IBB for a holding period ending on June 21st. The probability of a positive investment return is above normal and the average rally is above normal. However, the risk of taking an outright IBB position is also above normal with an average drop of 15.1% in case of a negative return.

read more ...

The Odds 2014 Will Be Just As Good As 2013

After a great year for the S&P 500 (SPY) in 2013, it's natural to wonder whether that type of pace can be maintained going forward into next year.

read more ...

The home page has been updated with a cumulative performance graph.

read more ...

How To Protect Yourself From Market Corrections – Or Worse

While personally I think the overall bull market has a long way to go there is no such thing as a sure thing in investing. I consciously keep in mind the small probability that this will be the third top of the new century before we head lower. However, while I admit the probability of this happening, I do not worry about it, because if it does, I will come out more than alright.

read more ...

New calculators, put option support and HTML5 revamp!

The website just got a nice shiny HTML5 face-lift. New calculators were added. Put option support was implemented and a yield curve page is now also available.

read more ...

The best way to think about gold price is to think in terms of exchange rates with gold being just another currency. The "Purchasing Power Parity" theory tells us that if the nominal price level increases in one currency (assuming no price level change in the other currency) then the exchange must deteriorate in favor of the other currency by the same percentage. In other words, the real exchange rate should always be static.

read more ...

Copyright © 2010-2021 Optionize Inc. All rights Reserved.

The information contained on this website is for information purposes only. Optionize Inc. is not responsible for the accuracy or timelines of any of the information. Please verify all prices with your broker prior to trading.